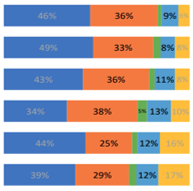

Palo Alto has been developing a proposed business tax, targeted for the November 2022 ballot. In Nov-Dec 2021, the City’s consultant FM3 conducted a poll of Palo Alto residents seeking to understand how they felt about such a tax and how they would like to see it used. Results included:

- A majority of residents were supportive, especially if small businesses were exempted and the tax applied mainly to large companies

- Top priorities revolved around funding and restoring basic city services lost in the pandemic, including public safety, roads, libraries, parks and recreation; funding for affordable housing and homelessness also ranked highly.

- Top current overall resident concerns included housing costs, climate change, homelessness and covid-19 impacts. The fastest-growing concern was crime.

Selected results of the poll can be found here. The City Council and City Staff will continue to refine the business tax concept over the next three months, with a final decision expected in May-June. Voters would vote on it in November.

PASZ take: we’ll reserve judgment until seeing the final version, but Palo Alto is one of the few Bay Area cities not to have such a tax already. The tech sector has created great wealth but also great need for services and infrastructure. We’d like to see small community-serving businesses exempted.

I agree, big business needs to be taxed for all those reasons. No reason that P.A. should not do it, all the cities around us are including EPA.